XTB

| Year of creation | 2002 |

|---|---|

| Minimum deposit | 0 |

| Leverage | 30 |

|---|---|

| Minimum trade size | 0.01 lot |

XTB

I tested XTB, and I will give you my opinion on this broker

Today I am trying the broker XTB, and I will share my opinion. This broker is one of the first on forex. It was created in 2002, one year before I started trading on this market. Its international expansion began shortly before 2010.

With XTB, you will have access to most markets: forex, indices, commodities, a nice selection of stocks and ETFs, and of course, crypto-currencies.

| 💹 broker | XTB (for X-trade Broker) |

|---|---|

| 🛍️ Assets available | Forex, Cryptocurrencies, Indices, Stocks, Commodities, ETFs |

| 💰 Minimum deposit | No minimum |

| 💰 Leverage | 1:30 |

| 🎮 Demo account | Yes |

| 📊 Trading platform | Proprietary platform: xStation 5 and xStation Mobile |

| 👱♂️ Users | 275,000 customers worldwide |

| 🥇 Specificities | One of the oldest brokers |

| ⚖️ Regulations | Banque de France, KNF (Poland), FCA (UK) |

| ⌚ Account opening time | 18 minutes open and validated account (watch in hand) |

My XTB review in a nutshell!

In this test, you will discover that XTB was one of the first online brokers. It was created in 2002. The broker is regulated in most European countries.

A large part of this test concerns the xStation platform, a proprietary platform. My test was very conclusive. The XTB platform is not perfect but, from my point of view, surpasses what exists on the market. It is complete, offers interesting information for risk management, gives statistics on your portfolio, allows you to train... I must admit that it was a surprise, to the point that I went so far as to open a real account with them after a few days of trying.

If you don't have time to read everything, I can tell you that XTB is one of the excellent brokers. Therefore, my sentiment is very positive.

Presentation of the broker XTB

X-Trade was created in 2002 in Poland. In other words, it is a veteran. Two years later, it changed its name to become XTB. From 2004 to 2010, XTB experienced strong international expansion and opened offices in several European countries. In 2016 the broker was introduced on the Polish stock exchange (capitalization has evolved between 100 million and 500 million euros. The founder Jakub Zablocki remained at the helm of the company during the first 10 years and, even if he launched on another project in finance, remains always involved in the management of the broker. It is a well-managed company which has not recorded a loss over the last five years, coupled with a good reputation. Therefore, I will not have any problem opening an account with them.

XTB has offices in many countries, including Poland, of course, but also France, the Czech Republic, Germany, Spain, Austria, Belgium... So it is easy to reach them, even by phone. I tested their commercial service, they replied in less than 2 hours, which is far from the case with all brokers. Moreover, their answers to my questions were very detailed and well-argued, a good point for them.

Markets/Available Assets and Trading Fees

XTB is a forex broker that has been able to diversify. To date, it offers a wide enough range to diversify its portfolio. In addition to forex, you can invest in indices, commodities, stocks, ETFs, and of course, cryptocurrencies.

They are very transparent. All of their fees are available on their site. For a basic account (non-professional), there are no transaction fees apart from CFDs on crypto-currencies (3.5€ for 1 Bitcoin or 10 ETH). Also, note that there are no fees when withdrawing money (apart from Paypal) which is not the case with all brokers.

Forex:

XTB offers 48 currency pairs and the possibility of trading in micro-lots (0.01 lot). The spreads remain pretty low. See table below.

Of course, among the currency pairs, there are all the major pairs (EURUSD, GBPUSD, EURCHF...), the minor pairs (GBPNZD, EURCAD, EURNOK...), and a nice selection of so-called exotic or emerging pairs that are often more volatile. (EURTRY, CHFPLN, GBPMXN...). But, in my opinion, it is more than enough. All the interesting pairs are present.

| Pair | Spread (in pips) |

|---|---|

| EURUSD | 1 |

| EURGBP | 2 |

| AUDUSD | 1 |

| NZDUSD | 2 |

| USDCAD | 2 |

| USDTRY | 300 |

The stock market:

For a short time, XTB has been offering to invest in shares free of charge (within the limit of 100k€ of transaction per month, which leaves a margin). More than 2000 stocks from 16 exchanges, including the United States (Apple, Netflix, Tesla, Google...), most European countries (Germany, France, Spain), United Kingdom, Switzerland. Short selling and leverage are possible via the CFDs available on the platform. Note that fees start from 0.08% on CFDs.

Financial information on companies is directly available on the platform. We have access to capitalization, dividend yield...

Most of the indices of the major world stock exchanges (Americas, Asia/Pacific, and Europe) are also available, with leverage ranging from 10 to 20.

Commodities:

If you trade commodities, you will also find what you are looking for. There are many instruments. It's a market that I don't touch at all, so I'll let you make up your mind about it. The leverage effect varies from 10 to 20, depending on the instrument.

- Agriculture: Cocoa, Cotton, Coffee, Sugar...

- Energy: Gas and Oil

- Metals: Nickel, Copper, Aluminum, Zinc

- Precious metals: Gold, Silver, Platinum, Palladium.

Cryptocurrencies:

I think that soon there will not be a single broker that does not offer crypto in its offer. There are about twenty crypto-currencies on its platform. There are, of course, the most prominent ones like Bitcoin, Ethereum, Litecoin, but unfortunately, you won't find Dogecoin there 💎🤲.

Risk enthusiasts can trade cryptos with a leverage of 2. In my opinion, you have to be ready to rodeo with your wallet if you play cryptos with a leverage of 2. Everyone takes pleasure in their own way 😶.

Trading platform

So far, we have seen that XTB is in the middle of what is expected of a broker: a wide variety of instruments and not too high fees. I admit that when I saw that they only offered one platform, a proprietary platform, I knew it was the part that could change everything in the perception I have of this broker. But you know me, I took the time to test, place orders, and try all the options available. The test of the platform will therefore be the essential part of this test and, without revealing everything to you, I was very pleasantly surprised. My opinion on XTB changed during this test! To seriously consider changing brokers, I will come back to this later.

First impression

The first time I opened the Station, I did not have a Wow effect. So be careful, don't make me say what I didn't say. The platform is very clean, seems, at first sight, very ergonomic, and gives all the information necessary for a trader like me, but I didn't feel like I was going up to aboard a SpaceX ship.

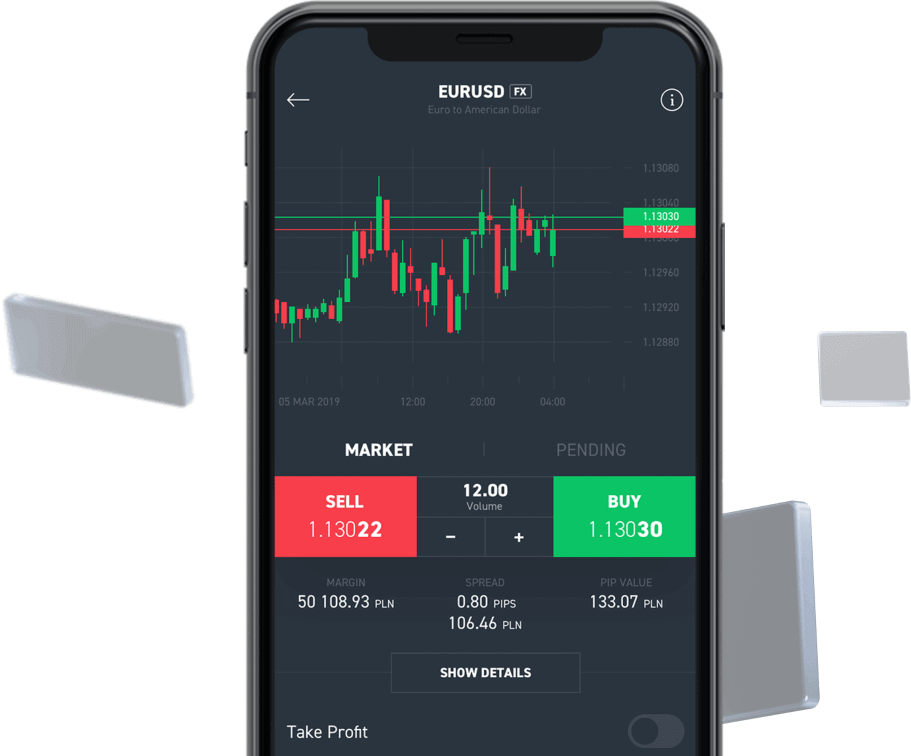

The first thing I did was to place an order, the search box works very well, so I found the Euro Dollar very quickly (good point). Then I'm looking for a way to put a stop (an order that allows you to limit the loss to an amount defined in advance) and a take profit (an order that will enable you to close the position automatically on a target), it's from this moment I had a little more trouble, I assure you, you don't need a nuclear engineering degree, but still, it lacks ergonomy.

Above each instrument, there is an SL/TP button (see screenshot below). By clicking on it, a small popup appears with two SL and TP fields. So far, nothing magic. We can put a value that we increment from 0.1 to 0.1 for the TP (for the SL, it is negative). The only problem is that we do not know what this value is for corresponds. Is it a value in euros, a percentage, pips? I place the order blindly. I discover that, in fact, they are pips. On the Euro Dollar, this is not a problem for me. I know the spread is roughly one pip. I know my price levels so that I can get away with it. But on Bitcoin, which I trade very rarely, with a spread of 95461 pips at the time of writing these lines, I don't know if I will use this SL/TP button. After reflection, I tell myself that it is probably helpful for a scalper (a scalper places orders with a time horizon of a few seconds to a few minutes,

Order placement

At that moment, I told myself that the test would be fast. For me, stops and take profits are essential. I cannot trade without them. But that was without counting on the little "+" button next to SL/TP. This tiny "+" button opens an order window! I don't know why they put this SL/TP button which doesn't have much use in practice, and put this little "+" so small.

The order window is very comprehensive. You can place a market order (instantaneous) or a limit order (pending) and adjust the volume (in increments of 0.01 lot in the case of forex) and the entry price as well as a date/time of validity. See screenshot just above)

We also can enter a Stop and a Limit (Take profit) that can be set either by giving a price, a number of pips, or a value. By modifying one of these values, the others adjust automatically. We even have the potential gain or loss in %. In short, all the data for risk management with small onions, I love it. Coming from MT4 and other more ancient platforms like Oanda or FXCM, it changes my life, and it is because of (or thanks to) this argument that I am seriously considering changing brokers.

I still finish my test of this order passage. On the same window, I can configure a trailing stop. I see the spread in real-time, the commission, the price of the pips, and the daily swap that I will pay (or receive if the interest rate differential is large enough). Everything is transparent, with no hidden fees. I know exactly what I'm getting into. On this point, they deserve their "grand prize of excellence" 🤯.

To be perfect, they should be able to give the option to display this order window when clicking on the "Buy" or "Sell" button.

Instruments

I have already told you about the instruments (forex, indices, stocks, crypto, ETF). The search engine makes it easy to find them, but the platform also allows us to put our favorite instruments as favorites and even create personalized groups. To add an instrument to your favorites, click on the star next to the name. To put it in a group, a right-click brings up a context menu with an option "add to group", from there you can choose to create a new group or click on an already existing group.

Graphics

The graphics are very clean and easy to read with the default colors. Many technical indicators are available such as MACD, RSI, Ichimoku, Bollinger bands... It is pretty easy to draw trend lines, Elliott waves, add text or geometric shapes. The platform saves all the modifications, so you will find them without problem the next time you open it (except in some instances described just after).

It is straightforward to place orders directly from the chart as far as trading is concerned. If you right-click, you will have the option to create a limit or market order. If you choose the limit order, the price displayed by default will be that given by the level of your mouse on the graph. Let me explain: if your mouse pointer is at 1.2000 on the Euro Dollar, the limit order will be settled automatically at 1.2000. This is a fairly standard operation but which is nevertheless very practical.

Position management can also be done very quickly from the chart. For example, to move a stop, just click and drag.

However, I see two downsides:

- The first is that it is not possible. In any case, I have not found a way to do it, to synchronize the graphics. For example, let's say I'm building an environment of three charts with different time units on the Euro Dollar (Having multiple time units helps to see what context we're in, for example, if I'm looking for patterns on an hourly chart, it's essential to know how prices behave on longer time units such as 4 hours and daily). Then, if I want to display the same configuration with another instrument, I have to change it on each chart. It would have been very convenient to be able to do this globally.

- The second is that the different plots (of supports, resistances, trend channels) are erased if I change instruments. So if I spend an hour analyzing the Euro Dollar and I change symbols to check the Pound on the same chart, everything will be erased when I come back to the Euro Dollar. So it would be nice to find everything when I come back to the Euro Dollar.

These are two points that should be corrected.

Basic information

I have already discussed it above. The platform gives some basic information on each instrument.

On forex, indices, commodities, and cryptos, you will have access to standard information such as the size of a pip, the value of a lot, the minimum and maximum size of a position, and more information such as the daily buying and selling swap.

On the stocks, you will find the stock exchange on which the stock is quoted, its currency, the commission in Euro (of 0%), the minimum size of the order. In the "company info" tab, you will have fundamental information such as capitalization (XTB had an excellent idea to put it in the currency of the account), the profit margin, various ratios and, information which may be interesting, the return on the dividend (the dividend is also indicated).

XTB also gives us market information like:

- A real-time news feed can be filtered by market (forex, crypto...). There is also a rapid search field.

- An economic calendar giving the dates/times of publication of macroeconomic indicators.

- Market analyzes are not really analyzes but rather indicators. We find there :

- a market sentiment indicator gives the percentage of each instrument's long and short positions.

- The biggest variations of the day can be filtered by market.

- A high-speed stock scanner

- A stock and forex heatmap.

Training

There is a training tab in which there are several series of videos that are only accessible to real accounts. Do not repeat it, but if you search in your favorite search engine for the title of the videos, you will find them. XTB has an account on the Vimeo site. You will find everything there 🤫.

Wallet statistics

This page is accessible by clicking on the "my account" menu at the top right and then the "statistics" tab. You will visualize the evolution of your portfolio, its gains, and its losses. There is a lot of information like the rate of winning trades, the maximum drawdown, the profits or losses, the number of winning and losing trades.

I would have asked for more details and statistics if I were fussy. But I'm particular, I love to analyze the numbers, and the more data there is, the better off I am.

Copy Trading

Here the test will be brief. Unfortunately, XTB does not currently offer copy trading. It will therefore be necessary to turn to eToro, which is, to date, in any case, the best copy trading broker that I have seen.

Regulations & licenses

XTB is authorized and regulated in most European countries (Poland, France, Germany, Spain, Portugal...), the United Kingdom, and Uruguay. This regulation means that XTB customers and their capital are protected. In addition, XTB is subject to controls and binding rules. In my opinion, it is a minimum to require from his broker.

Open a demo account

To open a demo account, nothing could be simpler. First, you must provide an email, give your country of residence and enter a password. Then you will have access to the platform for two weeks. If you want to access the demo platform without a time limit, you will need to open a real account without depositing any money.

If you want to try your hand at trading or change brokers, I can only advise you to test XTB. Frankly, their platform is worth the detour.

Open a live trading account.

I also tested the opening of a real account. You will need to fill out a ten-page form in which you will give your address, the source of the funds you wish to invest, and you will have to answer questions about your knowledge of the markets. It took me less than 10 minutes to fill everything out. The form is very fluid and ergonomic.

Then you will have to activate the account by sending a copy of an identity document and proof of address. Again, the interface is very ergonomic and straightforward. It changes from other brokers.

I haven't put any funds on this account yet, but in the meantime, I have my demo without time limit 💪

Now I have access to the training videos I mentioned above.

Accessible for beginners

Is XTB for beginners? Difficult question. I would say that if you really don't know anything about it, it will undoubtedly take a few days to understand how it works. But in this case, you will probably have the same problem with all brokers. Let's say that XTB is much easier to use than a broker that offers a platform like MT4, which I consider very difficult to learn (see my review on Avatrade ), but will be more complicated than a broker that will offer less instrument (a stock broker for example). In short, it is a tool for traders or those who want to become one.

Strengths & Weaknesses

| Assets | Weaknesses |

|---|---|

| ✅ The platform: I repeat myself, but it's a great platform. There are some flaws but so many advantages over others | ❌ Charts: The lack of synchronization between charts and the fact that analyzes do not register is very frustrating |

| ✅ No share fees. It's still a significant step forward ♥ | ❌ No copy trading. It is not very serious, but we can note it if it is essential for you. |

| ✅ All instruments in one platform. This is an opportunity to buy good old dividend stocks alongside some Bitcoin | ❌ The TP/SL button needs to be better explained or removed altogether. |

| ✅ The order window is complete. Probably the best I've had the opportunity to test so far |

CONCLUSION

This test is therefore conclusive. The proof I opened and validated a real account, I will continue my tests to see if I get used to it and if I am ready to leave MT4, but frankly, I am on the verge of doing so. The charting tools deserve some work. I'm used to TradingView charts, XTB is close, but it still lacks the little extra that makes the difference. However, if I compare to MT4 charts, XTB is top.

There is enough fundamental information to open our positions, the calendar, the news feed, company info... it's all there.

Statistics on account performance complete this good impression of a quality platform.

My overall opinion is, therefore, very positive. In my opinion, it is one of the few brokers who inspire confidence in me both technically and ethically.

Our final rating on XTB:

FAQs

XTB, reliable broker, or scam?

XTB is a reliable broker. It has existed since 2002, has offices all over Europe and therefore follows particularly strict regulations, has developed a very successful platform. In short, they have put the means to be part of the serious brokers.

What is the minimum deposit to open an account with XTB?

There is no minimum amount. You can open an account and not deposit anything, this will allow you to have access to training and the demonstration platform without time limit.

Risk Warning

CFDs are complex instruments and come with a high risk of losing capital rapidly due to leverage. 74%-89% of retail client accounts lose money when trading CFDs. You need to make sure you understand how CFDs work and can afford to take the high risk of losing your money.

Arnaud Jeulin Managing Director

After an engineering degree, Arnaud started a career as a developer. He worked with traders and back office to build prototypes and trading tools. Then he set up his own company, Mataf, in 2003.

For the last 21 years Arnaud has improved his knowledge of brokers and markets, he uses his expertise to enhance Mataf to help users to avoid unethical brokers and trading signal providers.

Products

Regulation

Trading platform

- ul. Ogrodowa 58, 00-876 Warszawa Biurowiec A, VII piętro, POLAND

- 32 Rue de la Bienfaisance, 75008 Paris, FRANCE

- Pobřežní 12, 186 00 Praha 8, CZECH REPUBLIC

- Highsight Rentals Ltd, 3075, Limassol, CYPRUS

- 35 Barrack Road, 3rd Floor, Belize City, Belize, C.A

- Mainzer Landstr. 47, 60329 Frankfurt am Main, GERMANY

- Praça Duque de Saldanha, Edíficio Atrium Saldanha, Piso 9 Fração B 1050-094 Lisboa, PORTUGAL

- Poštová 1, 811 06 Bratislava, SLOVAKIA

- Edificio Iberia Mart I Calle Pedro Teixeira 8, 6ª Planta 28020-Madrid, SPAIN

- Level 34, One Canada Square, Canary Wharf, E14 5AA, London, UNITED KINGDOM

- Unit 1204, Index Tower, Happiness Street, Dubai International Financial Centre, Dubai, 113355, UNITED ARAB EMIRATES

- Sucursala Bucuresti Bulevardul Eroilor, nr. 18, sector 5 Bucuresti, ROMANIA

- Av. Apoquindo 4501, Of 1604 - Las Condes, Santiago, CHILE

- Büyükdere Caddesi No :193 193 Plaza Kat: 2 34394 Levent İstanbul, TURKEY